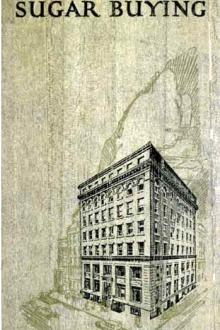

About sugar buying for Jobbers

About sugar buying for Jobbers

How you can lessen business risks by trading in refined sugar futures

Jobbers who have had considerable experience in exchange operations will find in this booklet a simplified and non-technical description of activities with which they may be in general familiar.We believe, however, that the inauguration of trading in refined sugar futures on the New York Coffee and Sugar Exchange, Inc., throws open a new realm of opportunity.

Book Excerpt

by the Exchange will appeal to those jobbers who wish to reduce the speculative element in their business.

In the example immediately following, as in all others, we have not taken into consideration the difference between the Exchange quotations and the Seaboard Refiners' quotations, which is explained on page 38. This would simply inject an unnecessary complication, and would be of no particular advantage for purposes of illustration.

Suppose you should buy through your broker from a refiner, for prompt shipment, an amount of actual sugar at 6.00, which you plan to sell within a short time after its receipt. Instead of worrying about subsequent sugar price fluctuations, you simultaneously hedge this purchase by selling futures in the same amount on the Exchange. The price at which you buy actual sugar and the price at which you sell futures should be relatively the same, since Exchange prices generally reflect refiners' prices.

You should be able to figure the cost of

FREE EBOOKS AND DEALS

(view all)Popular books in Non-fiction, Business

Readers reviews

0.0

LoginSign up

Be the first to review this book

Free Download

Free Download